But if you find that most of your petty cash is not being used, the fund amount might be too large. You should deposit the surplus petty cash into the company bank account. If you’re planning to create a petty cash fund, there are three basic procedures that are essential to follow. These procedures will allow you to keep your funds safe and to keep track of your funds. The remaining $185 on hand is what’s left of the $500 petty cash fund after reimbursements.

Determination of expenses

If you find yourself regularly replenishing your petty fund there could be a larger problem at hand. Every time you replenish your fund, look over the spending log to see where the money’s going. If there are any odd transactions or the numbers don’t add up, you could be looking at theft.

Appoint a petty cash custodian

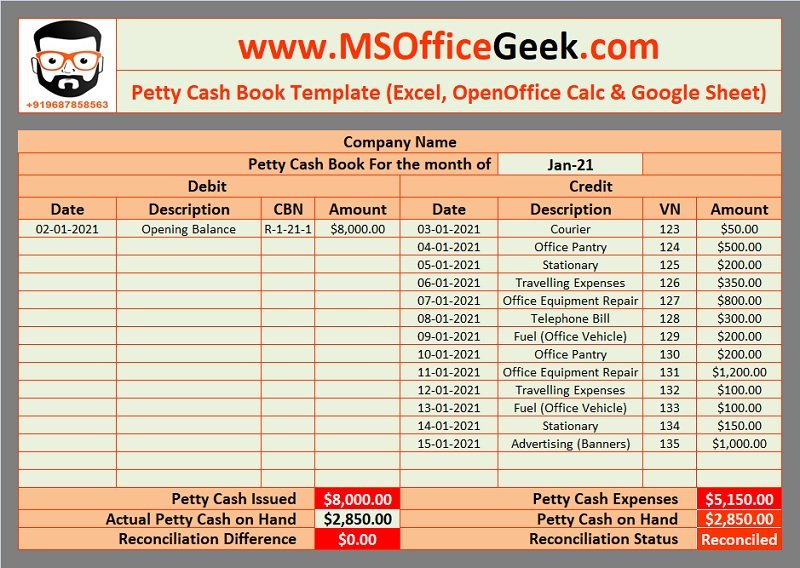

Petty Cash Book is an accounting book used for recording cash expenses which are small and of little value, for example, stamps, postage and handling, stationery, carriage, daily wages, etc. At the end of each month, when the petty cashier approaches the main cashier for reimbursement, the latter will prepare a cheque voucher. In all businesses, some capitalizing software development costs for saas companies payments are made by check for better control over cash. However, for the payment of small expenditures (e.g., stationery, travel, postage, and newspapers), paying by check is unreasonable. So, for example, the petty expenses categories of your business are refreshments, bus tickets, office stationery, postage, and other miscellaneous expenses.

Enhances accountability

As the name implies, there are two columns for this type of cash book. It allows users to keep more detailed notes about their transactions. There are several types of cash books that entities can use, whether they’re businesses or individuals.

- While small expenses may not be considered very important to take note of, they can add up over time and have a significant impact on the finances of the company.

- Using a cash book is a great way to help manage and account for cash-related transactions, including receipts and payments.

- There might be errors in data entry or compliance issues that are causing trouble in the finances of the company.

- By digitizing and standardizing the reimbursement workflow, organizations can reduce processing times, enhance accuracy, and ensure a seamless flow of funds back into the petty cash system.

- Keeping careful records of cash expenditures will be a huge help when it comes time to reconcile your petty cash account.

If you’re worried about employees pilfering the petty cash, research has shown that encouraging them to keep photos of loved ones around might help stop this problem. According to the Harvard Business Review, study subjects were significantly more honest on self-reported tests when they could see a picture of loved ones. The theory is that seeing those photos encourages people to behave more ethically. In the balance column, it will show how much cash remains within our box. Journal entries for each receipt and payment are posted in the Petty Cash Account on the debit & credit sides.

How much are you saving for retirement each month?

Even though petty cash might seem minor, you still need a proper organizing and record-keeping system, with a clear audit trail of every expense. The usage is similar to the above template, but we separate the cash in and cash out (cash received and cash paid) into two columns. We can tract the total cash flow easily by looking at the total balance of both columns. Here is another template which also useful for accountants to control their petty cash balance. It depends on the company policy to reconcile the petty cash, we usually reconcile at the month-end in order to ensure there is no missing cash.

The key columns in a petty cash book include Date, Particulars (Description of Expense), Voucher Number, Amount Spent, and Balance. Since the expenses are checked regularly, and the accounts are submitted promptly, this method’s chances of expense fraud are non-existent. Thousands of challenges arise, and hundreds of problems must be solved daily while managing an organization’s finances. Petty cash expense and maintaining a petty cash book is one such challenge that you must never take lightly. Every once in a while, compare the petty cash balance recorded in your petty cash log with the actual remaining amount of cash in your lockbox.

Regular reconciliation acts as a meticulous detective, unveiling any discrepancies that may arise between the recorded transactions in the petty cash book and the actual expenditures incurred. This early identification is pivotal in maintaining the integrity of financial records. Regular reconciliation of petty cash books is a pivotal practice in financial management. This segment underscores the significance of this process in maintaining accuracy, accountability, and financial transparency within an organization. In accounting, reconciliation is the process of ensuring that two sets of records are in agreement.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The amount spent by the petty cashier is reimbursed, thus making up the balance to the original amount. To solve these problems, the chief cashier delegates responsibilities to another senior staff member to account for day-to-day small transactions. In addition, the chief cashier in a large business is required to handle numerous large transactions on a daily basis.