Commercial transactions are increasingly cashless—even at small retailers and restaurants, where purchases traditionally have relied heavily on coins. The Internal Revenue Service (IRS) recommends filing out petty cash slips and attaching them to receipts to record and document petty cash expenses. During the normal course of operations, numerous financial transactions are taking place within the company. In this regard, it is often challenging for companies to keep a proper track record of the expenses that they have incurred. To reimburse expenses, require a receipt from the employee and then provide them with the exact amount of cash and coins from the lockbox. Then, place the receipt in the lockbox and record the expense in the petty cash log by entering the date, payee, description, reference number, and amount.

Related AccountingTools Courses

The predetermined fixed amount ensures that petty cash remains a manageable and monitored resource. Institute a clear process for the timely replenishment of petty cash funds. Regularly assess the balance and initiate replenishment to prevent shortages that may disrupt operational activities. Enforce a policy requiring employees to provide receipts for every petty cash transaction.

Reduced risks of fraudulent expenses

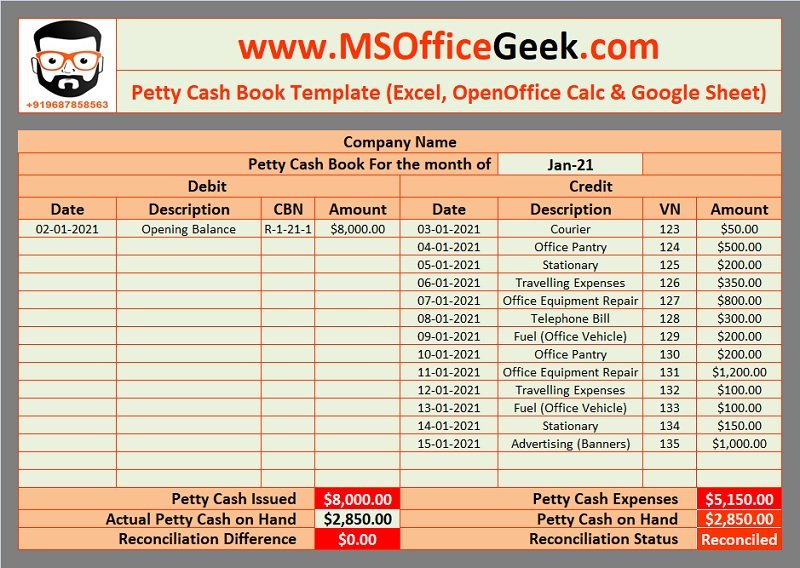

Every time an expense is made, it is recorded under its specific column. This running balance reflects the remaining funds in the petty cash, aiding in real-time monitoring and facilitating quick assessments of available resources. Whenever an expense requirement is raised, the petty cashiers make a Petty Cash Voucher (PCV). Before giving this PCV, the cashier records the particulars of the expense, amount, date, and petty cash voucher number. Furthermore, keep a Microsoft Excel doc or other spreadsheets that tracks who spent what, when it was spent, and the total amount of spending for both the month and year to date. Not only will this help you hold employees accountable, it will also ensure you’re more prepared at tax time.

- However, many companies are scrapping the old bookkeeping system to overcome this.

- This real-time monitoring enhances control and facilitates timely decision-making based on current financial data.

- This guide will make it clear what petty cash is exactly and walk you through how to properly manage a petty cash fund, from setting up clear guidelines to logging every transaction.

- When a payment needs to be made from the petty cash fund, the petty cashier prepares a petty cash voucher (PCV).

- These transactions should be present on your financial statements and recorded in a manner that oversees the replenishment of your funds.

Which of these is most important for your financial advisor to have?

Many expense management systems nowadays have mobile apps that let employees submit pictures of the receipts. The funds that the head accountant gives are stored before the expenses actually happen. Each petty cash expense has a separate column, and the totals of each expense are calculated automatically. An analytical petty cash book is different from the previous one as it has on single cash field on the debit side and a separate date field.

Automate reconciliation and reimbursements

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. 11 Financial is a registered investment adviser located in Lufkin, Texas.

Petty cash book: Format, types, operation, and advantages

Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Bench simplifies your small business accounting by combining intuitive software that inventory management methods automates the busywork with real, professional human support. Next, total the amount of all the outstanding slips (plus attached receipts). This figure should be the same as the withdrawn sum you calculated from the account starting and ending balances.

Assign each transaction to specific categories to provide a clear breakdown of how petty cash is utilized, enhancing expense tracking and financial analysis. This balance represents the amount of cash available in the petty cash fund at the beginning of the accounting period. Ensure that the opening balance of the petty cash fund is accurately recorded. The opening balance will change every financial period depending on the leftover balance from the previous period. If you’re running a proper log as mentioned above, you’ll also be able to easily gather up your petty cash vouchers and cross-reference them with your books to ensure things are accurate. This will set you up for success, not a petty cash accounting nightmare.

Therefore, recording petty cash transactions on the main cash book could make everything chaotic and complicated. That is why it is recommended to maintain a separate petty cash book for small transactions. An analytical petty cash book is the most effective way to record petty cash payments. A separate column is assigned for each petty expense on the credit side. Whenever a petty expense is recorded in the total payment column, the same amount is recorded in the relevant petty expense column. The petty cash book should be reconciled regularly, at least monthly, to ensure that the recorded transactions match the actual cash on hand.

Financial accountants (and independent auditors) are generally not concerned with petty cash because of the immateriality of the amounts. Management should be concerned about controlling the proper use of petty cash. Whatever steps are deemed necessary (such as surprise counts) should be performed to assure that controls are adequate. Since 2016, Stenn has powered over $20 billion in financed assets, supported by trusted partners, including Citi Bank, HSBC, and Natixis. Our team of experts specializes in generating agile, tailored financing solutions that help you do business on your terms. As a business grows, managing petty cash across multiple locations or departments can become increasingly complex.