While petty cash records capture transactions, they may lack the depth of documentation required for a comprehensive financial overview. The meticulous recording of numerous small transactions can make bookkeeping a time-consuming endeavor. The sheer volume of entries poses a challenge, demanding dedicated effort and attention to detail in the bookkeeping process. Employees may often use the petty cash fund for a particular reason that might not be permitted as per the business policy and report it to be some other type of expense instead. The inherent cash nature of petty cash creates a vulnerability to misuse. It places a responsibility on individuals to ensure the accuracy of petty cash records, fostering a culture where financial responsibility is ingrained at every level of the organization.

Accounting for Petty Cash

If the petty cash fund is over, a credit is entered to represent a gain. If the petty cash fund is short, a debit is entered to represent a loss. The over or short account is used to force-balance the fund upon reconciliation. A petty cashier might be assigned to issue the check to fund the petty cash drawer and make the appropriate accounting entries.

Step 2: Choose a petty cash custodian

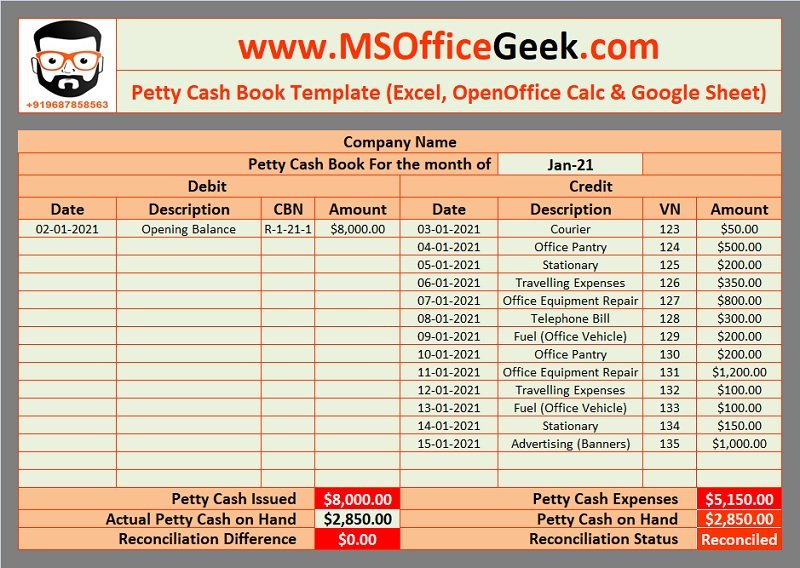

There are separate columns to track each transaction’s specifics, date, and debit or credit amount. The credit side has columns for all the cash expenses set in chronological order. The logical first step is to document the reimbursement, for example by writing out a receipt.

Get a complete view of your finances with QuickBooks accounting software for small businesses

A simple type of petty cash book is one that is maintained simply with the help of 2 primary columns, one for receipts (left) and one for payments (right). Leveraging a software solution also helps ensure that all transactions are centralized in one place. All these features and benefits improve accuracy, efficiency, and real-time invoicing guides and tips for dummies insights into the status of petty cash funds. This segregation ensures financial clarity and simplifies monitoring. The account should be easily accessible to the petty cash custodian while maintaining security protocols. Basically, the petty cashier receives money from the head accountant in the form of a cheque.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- Whether it’s transaction approvals, fund replenishment needs, or discrepancies, these mobile alerts ensure immediate awareness, enabling swift and informed decision-making.

- Expense management solutions like Happay offer petty cash management software and prepaid to manage businesses with multiple locations, offices, and outlets.

- Before going to the cashier, she should first complete the bottom of the petty cash log.

- It depends on several factors, such as the demand for petty cash during regular operation.

It might be tempting to wing it for as long as you can, but setting up a proper petty cash system early is crucial. Learn how to build, read, and use financial statements for your business so you can make more informed decisions. The magic happens when our intuitive software and real, human support come together.

Regarding the petty expenses, he can always refer and verify using the imprest petty cash book. In this step, there’s an appointment of a petty cashier who takes care of the petty cash fund. To meet the daily petty expenses, a fund is created, and a cheque is given to the petty cashier. After spending the money, the cashier submits the accounts with receipts to the main cashier for approval. Make sure everyone with access to petty cash funds knows what they’re for, and provide some examples of typical petty cash expenses to make sure there’s no confusion.

The petty cash custodian is charged with distributing the cash and collecting receipts for all purchases or any uses of the funds. As the petty cash total declines, the receipts should increase and add up to the total amount withdrawn. If you’re looking to manage your petty cash fund well, it will take time and effort.

Finally, the total money column on the credit side, which records all expenses, will give the total expense. Once you’ve entered your petty cash transactions on the books, your bookkeeping can use them while creating financial statements—so you can accurately factor petty cash into your expenses. Each time you tap into a petty cash fund—that is, take money out—a slip or voucher should be filled out. This acts as a receipt, logging the amount of the withdrawal, the date, the purpose, and other details. Increasingly, these slips are electronic ones, entered in a digital spreadsheet or ledger. But it can be helpful to keep paper slips too, along with receipts from the purchases or payments (if possible).